The unprecedented tariff regime implemented under the Trump Administration has created a perfect storm for customs fraud. With tariffs reaching levels not seen in nearly a century—including various baseline rates for most countries 15% to over 40%, 25% levied against imports from key trade partners Canada and Mexico, India and Brazil tariffs at 50%, and tariffs on Chinese goods escalating to 245%—the financial incentives for evasion have never been higher. Trade experts and enforcement officials recognize a fundamental truth: high tariffs create high incentives to cheat.

This enforcement environment has triggered the most aggressive customs fraud crackdown in modern history. From January 20 to August 8, 2025, U.S. Customs and Border Protection (CBP) uncovered more than $400 million in unpaid import duties through enforcement investigations, identifying 89 cases with reasonable suspicion of duty evasion in that period alone. The Department of Justice has explicitly identified “trade and customs fraud, including tariff evasion” as a high-impact priority area, reorganizing resources into a specialized Market, Government, and Consumer Fraud Unit and expanding whistleblower incentive programs to cover customs violations.

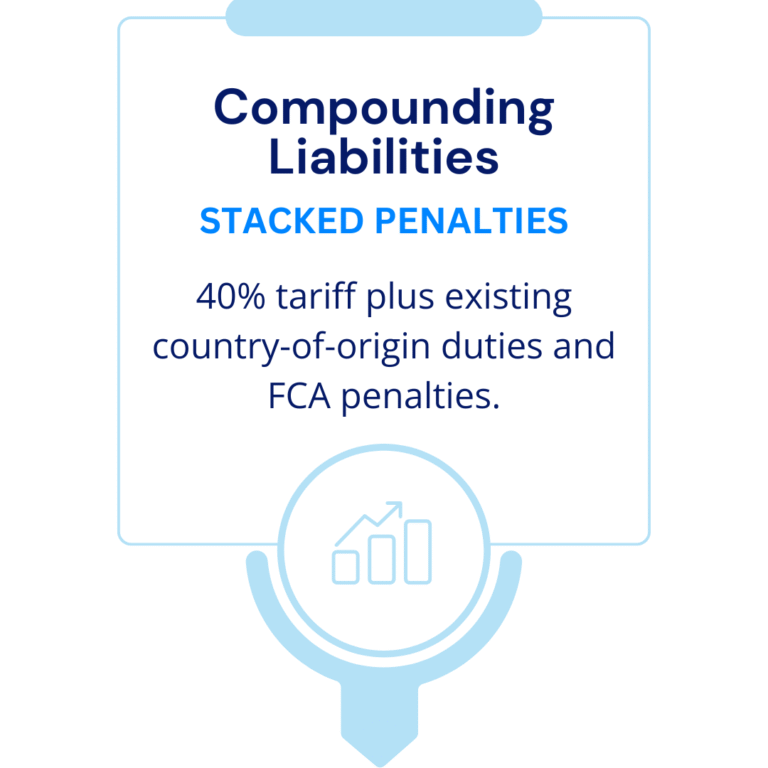

Four primary illegal schemes dominate the enforcement landscape: 1) undervaluation of goods, 2) misclassification of products, 3) country of origin deception, and 4) transshipment. Each carries severe criminal and civil penalties under multiple federal statutes, including the False Claims Act (FCA) (with treble damages), criminal customs violations (with potential imprisonment), and the new 40% transshipment penalty tariff that cannot be mitigated or remitted.

Scheme 1: Undervaluation of Goods

Undervaluation represents the most prevalent form of customs fraud, exploiting the ad valorem nature of tariffs calculated as percentages of declared value. By artificially reducing declared values, importers proportionally reduce their tariff obligations—a particularly attractive option when facing tariffs of 25% to 245%.

Common Undervaluation Methods

1. Invoice Manipulation and Double Invoicing Systems The most direct approach involves creating false invoices showing artificially low prices. Recent DOJ enforcement reveals companies systematically maintaining dual invoicing systems: one set showing actual transaction values for internal purposes and another showing reduced values for customs declarations. In a recent FCA prosecution, the government alleged that importer Barco Uniforms used “cost sheets” proposing underpayment of duties and maintained two sets of invoices—one with real prices and another with artificially low prices designed to cause false submissions to CBP.

2. Related Party Transaction Manipulation Companies exploit relationships with affiliated entities to create artificial pricing structures bearing no relationship to fair market value. These arrangements involve routing transactions through subsidiaries or shell companies, allowing importers to claim artificially low transfer prices while maintaining actual commercial arrangements at market rates.

3. Payment Timing and Consideration Splitting Sophisticated schemes involve manipulating payment timing or splitting actual consideration across multiple periods. Companies may delay payments, provide post-importation rebates, or structure transactions to declare only partial values at importation while deferring additional consideration through side agreements.

Scale and Detection

Recent enforcement actions reveal systematic undervaluation by 70% or more. The magnitude of these discrepancies demonstrates deliberate fraud rather than inadvertent compliance errors. CBP increasingly employs sophisticated data analytics to identify statistical anomalies and pricing patterns suggesting fraudulent activity, making detection more likely through algorithmic monitoring of import valuations against industry benchmarks.

Case Studies and Penalties

The $22.8 million settlement in 2023 with a vitamin importer demonstrates the scope of undervaluation enforcement. The company allegedly misclassified imported vitamins and supplements to avoid customs duties, then failed to pay back duties after correcting misclassifications. Similarly, a California wood flooring importer paid a $8.1 million settlement in March 2025 to resolve allegations of knowingly evading customs duties through undervaluation schemes.

Scheme 2: Misclassification of Products

Classification System and Vulnerabilities

The Harmonized Tariff Schedule of the US (HTSUS) contains thousands of classification codes with varying duty rates. Misclassification schemes exploit this complexity by declaring goods under incorrect codes carrying lower tariff rates. With country-specific tariffs now ranging from 10% to over 40%, plus underlying HTSUS rates, classification manipulation can produce substantial duty savings.

Common Misclassification Strategies

1. Product Description Manipulation Importers alter product descriptions to fit lower-duty classifications while maintaining actual product functionality. This involves exploiting technical classification criteria or regulatory definitions to claim products fall under preferential categories.

2. Component vs. Finished Product Classifications Sophisticated schemes involve importing finished products as “components” or “parts” subject to lower duties, then assembling or repacking domestically. CBP scrutinizes these arrangements under “substantial transformation” analysis to determine proper classification.

3. Dual-Use Product Exploitation Products with multiple potential uses may qualify for different HTSUS classifications with varying duty rates. Importers may misrepresent intended use to claim lower-duty classifications while actually employing products for higher-duty applications.

Enforcement and Detection

CBP’s analytical capabilities increasingly identify classification anomalies through pattern recognition. Unusual spikes in imports under specific HTSUS codes, particularly lower-duty classifications, trigger investigation. The agency also conducts physical inspections to verify that imported products match declared classifications.

Scheme 3: Country of Origin Deception

Legal Framework for Origin Determination

U.S. law determines country of origin based on the location of “substantial transformation”—the last place where goods underwent significant manufacturing processes changing their nature, name, or use. Simple assembly, packaging, or minimal processing does not confer new origin status, making many attempted origin manipulations legally invalid.

Common Origin Deception Methods

1. False Documentation and Certificates The most direct approach involves forged certificates of origin, mislabeled packaging, or cooperation with overseas suppliers to misidentify production locations. Recent CBP investigations revealed xanthan gum cases where Indian and Indonesian suppliers provided false origin paperwork for Chinese-manufactured products, despite neither country having xanthan gum production capacity.

2. Shell Company Operations Complex schemes involve establishing shell companies in low-tariff countries that purchase Chinese goods, perform minimal processing, and re-export with false origin documentation. These operations often involve minimal physical presence or production capability in the claimed origin country.

3. Manufacturing Process Manipulation Importers may attempt to create artificial “substantial transformation” through minimal processing in intermediate countries. However, enforcement actions demonstrate that courts require genuine, substantial manufacturing changes rather than superficial modifications designed solely for tariff avoidance.

Recent Enforcement Actions

CBP’s largest investigation under the Enforce and Protect Act (EAPA) involved 23 U.S. importers and Chinese shell companies funneling goods through Indonesia, South Korea, and Vietnam, resulting in over $250 million in unpaid duties. Every importer investigated was found in violation, with the revenue figure expected to increase as investigations expand.

The Toyo Ink settlement demonstrates origin deception consequences. The Japanese company paid $45 million to resolve allegations that finishing work in Japan and Mexico was “insufficient to constitute substantial transformation” for Chinese and Indian pigments, making origin declarations false.

Scheme 4: Transshipment

Definition and Scope

Transshipment involves routing goods through third-country intermediate ports or facilities to disguise true country of origin and circumvent duties. This scheme has become increasingly sophisticated as Chinese manufacturers implement “China Plus One” strategies, with Chinese foreign direct investment into ASEAN nations growing from $7.1 billion to $19.3 billion from 2020 to 2024.

Transshipment Methods and Networks

1. Third-Country Routing Networks Systematic transshipment involves establishing networks through Vietnam, Malaysia, Thailand, Cambodia, and Indonesia. Chinese exporters ship products to these countries, perform minimal processing or repackaging, then export to the U.S. with false origin documentation. CBP investigations reveal these networks often involve multiple shell companies and sophisticated document manipulation.

2. Production Integration Schemes More sophisticated transshipment involves partial production integration, where Chinese manufacturers establish legitimate production facilities in intermediate countries but maintain Chinese sourcing for major components. These arrangements exploit “substantial transformation” rules by claiming that assembly or finishing work confers new origin status.

3. Document and Labeling Manipulation Transshipment schemes require extensive document falsification, including bills of lading, commercial invoices, packing lists, and certificates of origin. Products may be repackaged, relabeled, or provided with false marking to support origin claims.

The New 40% Transshipment Penalty

President Trump’s July 31, 2025 Executive Order established a revolutionary 40% penalty tariff for goods determined to be transshipped, representing the most aggressive anti-transshipment measure in U.S. history. Key provisions include:

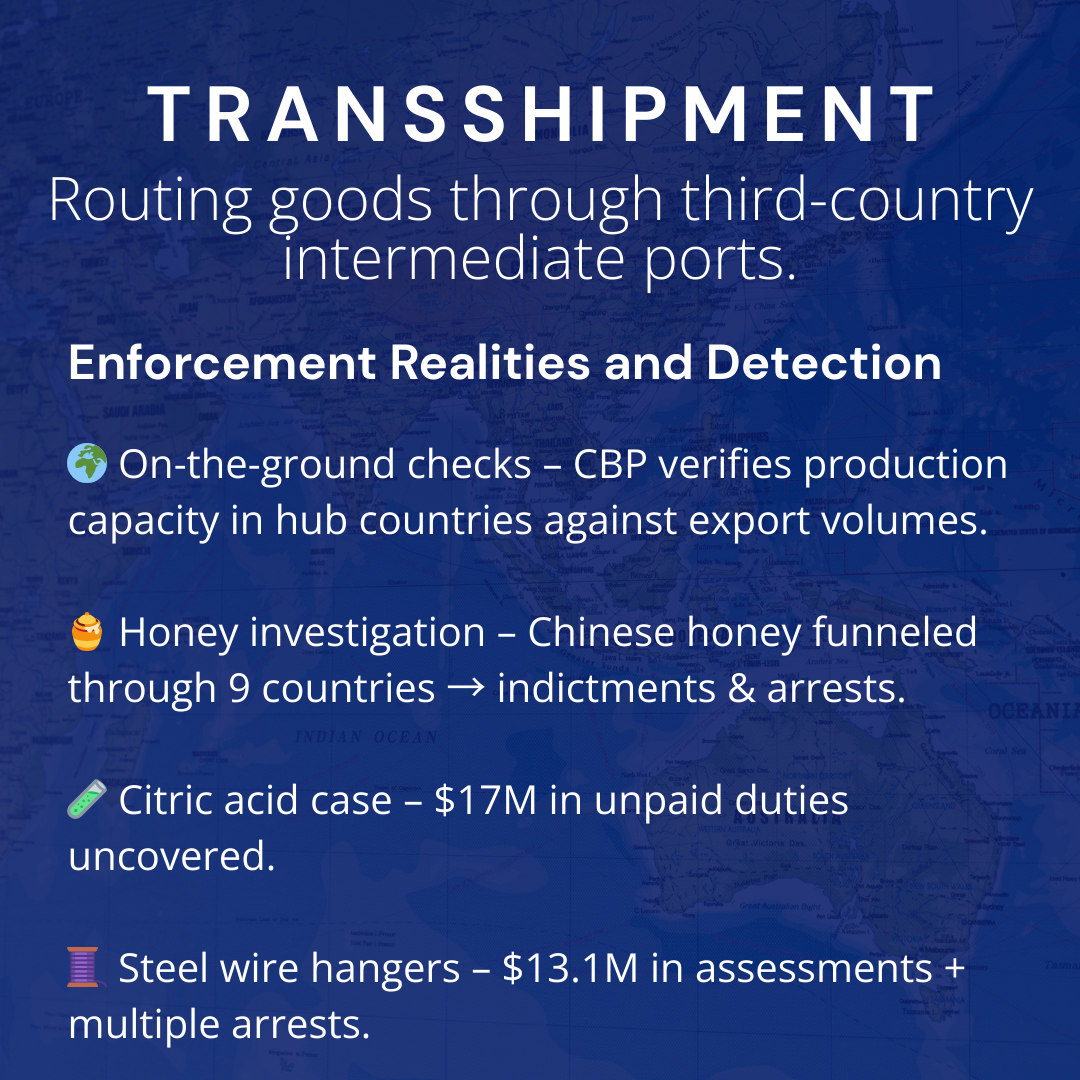

Enforcement Realities and Detection

CBP conducts on-the-ground verifications in transshipment hub countries, analyzing production capabilities against export volumes. The agency’s honey transshipment investigation revealed Chinese honey routed through Russia, India, Indonesia, Malaysia, Mongolia, the Philippines, South Korea, Taiwan, and Thailand—leading to numerous indictments and arrests.

Recent operations demonstrate enforcement scope: CBP detected Chinese citric acid transshipment resulting in $17 million in unpaid duties, while steel wire garment hanger investigations through Vietnam, Korea, and Mexico concluded with $13.1 million in assessments and arrests.

Southeast Asia Impact and Compliance Challenges

The transshipment crackdown creates particular challenges for Southeast Asian economies integrated with Chinese supply chains. A strict interpretation could devastate countries like Vietnam, Indonesia, Cambodia, and Malaysia if goods containing any significant Chinese input face penalty tariffs. Companies utilizing “China Plus One” strategies now face fundamental reassessment of their supply chain models.

Conclusion

The current tariff environment has created unprecedented enforcement risks for U.S. importers and their global supply chain partners. The combination of record-high tariffs, sophisticated government detection capabilities, enhanced whistleblower incentives, and severe penalty structures makes customs compliance not merely a legal obligation but a business imperative critical to corporate survival.

The four primary evasion schemes—undervaluation, misclassification, origin deception, and transshipment—each carry potential penalties that can exceed the value of affected merchandise. With False Claims Act treble damages, criminal liability exposure, and the new 40% transshipment penalty, total exposure can reach levels that threaten corporate viability.

Companies must recognize that traditional compliance approaches are insufficient in this enforcement environment. The government’s deployment of specialized prosecution units, advanced analytical tools, and international cooperation networks means that systematic evasion will likely be detected and prosecuted. The costs of implementing comprehensive compliance programs pale in comparison to the potential financial and reputational damage from customs fraud violations.

The consolidation of DOJ enforcement resources, CBP’s record penalty levels, and the elimination of mitigation options for transshipment violations signal that customs fraud enforcement will remain a high government priority. Companies that fail to adapt their compliance programs to this new reality do so at their peril, facing not only substantial financial exposure but potential criminal liability for executives involved in systematic violations.

In this high-stakes environment, proactive compliance investment represents essential risk management rather than optional expense. As enforcement capabilities continue expanding and penalty structures become increasingly severe, the margin for error continues to shrink, making robust compliance programs more critical than ever for companies engaged in international trade.

Written By:

John L., Director of Global Strategy, OpenRoad Global, Inc.